If you own a car you should know that you have responsibilities that you cannot avoid, one of them is the payment of the Tax on Mechanical Traction Vehicles (ITVM), known to all as road tax. Assuming the payment of this fee is a mandatory procedure and must be done once a year.

For many it is common to forget this responsibility and therefore, it is necessary check if it has been paid or not to avoid inconvenience and the payment of fines. Next we will teach you how to know if you are debt free and some other details that you should know about this tax.

How do I know if I already pay the ITVM?

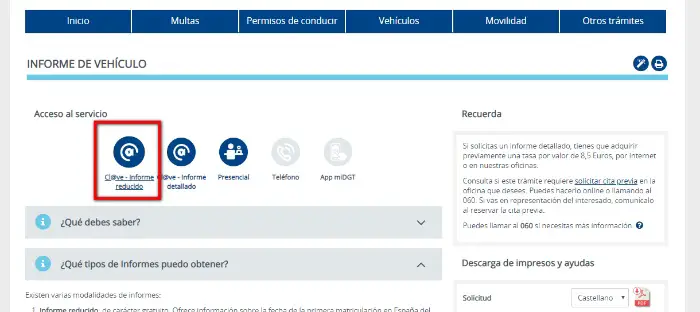

If you have doubts about whether or not you paid the road tax, you can request an online report by entering the portal of the General direction of traffic.

Once there select the option Vehicle Report located in the menu Formalities and on the page to which you will be redirected, click on the option Cl @ ve-Reduced Report.

Now choose the identification method that best suits you between DNIe / Electronic certificate, 24-hour PIN access and permanent Cl @ ve. Take into account that in some cases it is necessary to make a prior registration or request.

By accessing the system and getting your report, you will be able to verify the information regarding the payments you made to the public administration, which includes the road tax

If you want more information you can request a Detailed report, but in this case you must pay 8,5 euros for the service. This request only takes a couple of hours and can be paid with your credit card. For more information, call 060 or visit an office of the Directorate.

How do I pay the road tax?

You must pay the fee from April 1 to June 1, 2020 by any of the following ways:

- Onsite- This is the most common payment method. You only have to go to a financial institution or to the headquarters of the City Council of residence.

- By Internet: many prefer to direct the payment so that the payment is made automatically to avoid visiting the City Council every year. You can also make the payment from your bank's web portal.

- By phone: contact the telephone bank or dial the Citizen Service number (010) and pay using your credit or debit card.

What are the consequences of not paying the tax?

If you decide not to pay the road tax, you will have to answer for a fine whose value is much higher than the tax.

It begins as a municipal debt, but it can accumulate until it becomes a traffic fine that can exceed 500 euros and would result in the repossession of your vehicle.

We recommend that when buying a vehicle you verify that it is debt free, for this you can visit the General Directorate of Transit and ask for a detailed vehicle report as we mentioned before.

Other details about the road tax

Responding to the road tax debt is an obligation of the owner of the vehicle, regardless of whether it is a natural or legal person.

It is worth noting that the registration tax and the circulation rate are completely different rates, but many people make the mistake of confusing them. The registration fee is paid when buying a new car, therefore it happens only once. While the circulation fee must be paid annually.