At the end of 50 basis points today, as rates stand at 3%, Lagarde has added the announcement of another 50 basis point suffered in March. Because he decided to take the job of analysts, whose activity is based on general expectations.

The ECB will follow the reunion tips in reunion and extensive in the data, but its president justifies that the governing council has advancing data that increases in "significant" tips will continue to be necessary to reach a level of restriction in monetary policy that favors inflation of 2% in the medium term.

And he won't stop until he does. "We will raise the rates by 50 basis points at the next meeting and then we will evaluate the path from there," he said at the press conference after the board meeting in Frankfurt, in which he commented that "we know we still have way to go and we know what we have done, and the current pressure on the underlying CPI justifies a further rise in March. The ECB has also announced that the asset purchase program will be reduced by 15.000 billion euros per month on average from the beginning of March to the end of June.

We are in a scenario of another rise of 50 basis points in May. Among the members of the Governing Council, there has been a "vast majority" in favor of the two increases, according to Lagarde, who has described the governors of the central banks as "passionate" in contributing points of view and solutions. There are "different points of view", he has acknowledged, especially in the communication of monetary policy, but the consensus around the decisions and around his "legitimacy" on the data offers enough confidence for the ECB president, aa despite the "side effects" that Lagarde acknowledges.

"We expect growth to remain weak," he said, "high inflation and tighter financing conditions are holding back spending and output." The ECB watched with concern the evolution of energy resources, particularly gas, and specified it in the way in which companies and banks are reacting to the rating as the "inflation shock".

The institution is aware that "job creation may decrease and unemployment could increase", but insists that "the economy is more resilient than expected" and that is why Lagarde insists that "it is important to reduce fiscal support » . I had to hear that fiscal measures by euro governments, likely to leave inflation-reducing money in voters' pockets, could exasperate inflationary pressures that require a stronger response from the ECB.

According to his analysis, “bottlenecks in the supply chain are gradually easing, gas supplies are more secure, companies are running on large order backlogs, and confidence is better.” In addition, "production in the service sector has remained supported by the continuous effects of the reopening and a greater demand for leisure activities," Lagarde conveyed his optimism.

Rising wages and the recent drop in energy price inflation also help alleviate the loss in purchasing power that many people have experienced due to high inflation, thus helping consumption. "The economy has shown more than ever and will recover in the next few quarters," he is confident, but despite the positive outlook, Lagarde has once again stressed that "inflationary pressures are high and are spilling over to food."

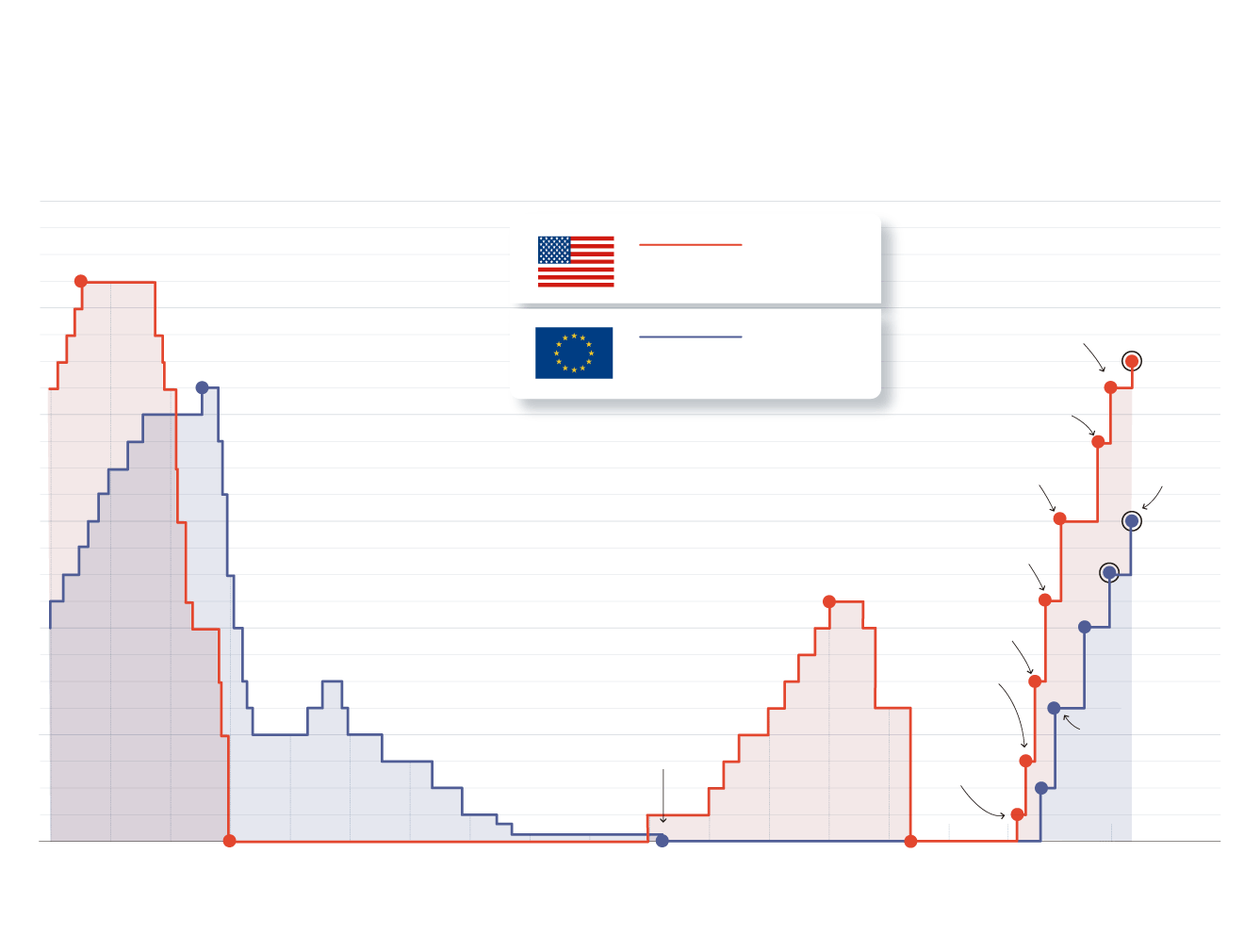

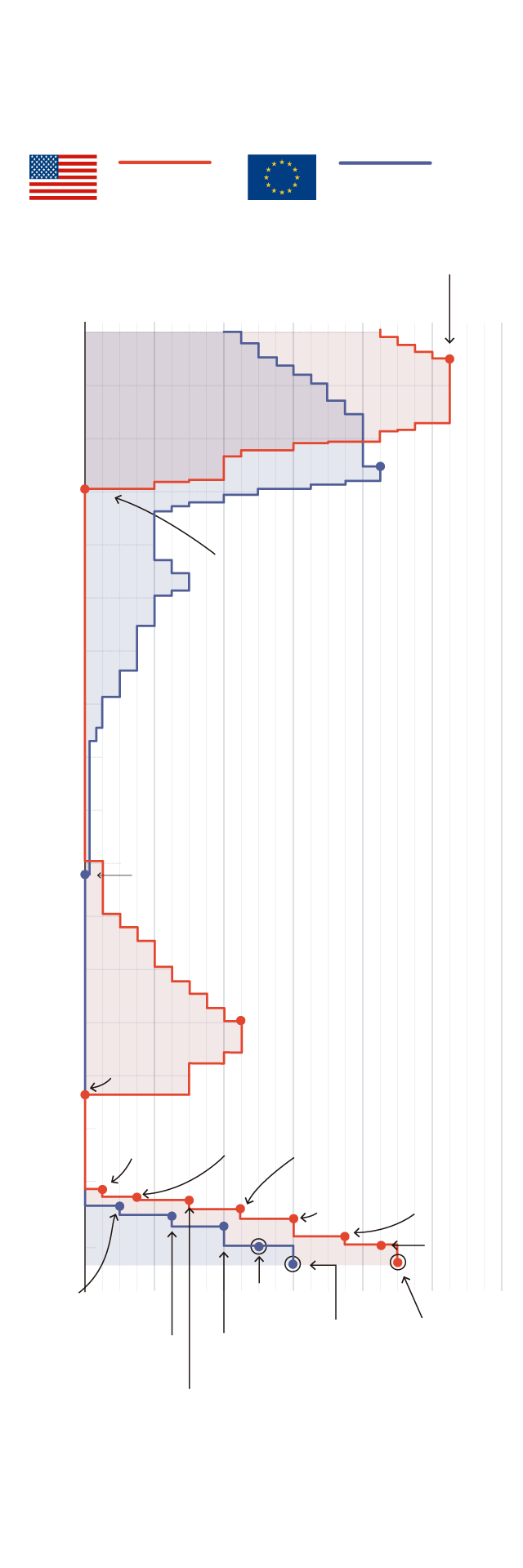

Evolution of interest rates

in the United States and Europe

Source: European Central Bank / US Federal Reserve

Evolution

of interest rates

in the United States and Europe

Source

European Central Bank

United States Federal Reserve

That is why he has defended that keeping interest rates at restrictive levels will reduce inflation over time by slowing down demand and also against the risk of a persistent increase in prices”. “We are still going to need significant increases in interest rates to reach a sufficiently restrictive level of monetary policy so that inflation reaches the objective in a sustainable manner”, he has sentenced.

From now on, the deposit rate for banks remains at 2,5%, the refinancing rate rises to 3% and the emergency window rate rises to 3,25%. These are the three indicative and official rates of the eurozone that will set the rate of market rates such as the Euribor or the interest paid by letters or sovereign bonds.