El Model 360 It is based on a document that is granted to all those professionals and businessmen who belong to the European Union and who are entitled to recover the contribution of the paid contributions of the Value Added Tax (VAT), whose origin is based on the purchase of goods and services from community countries, such as the Canary Islands, Ceuta and Melilla.

This regime corresponding to the deliveries of goods and acquisitions made intra-community by businessmen and professionals is characterized by the fact that the “Neutrality Regime in VAT "This means that it is the application of the VAT exemption that is provided for in Art. 25 and 26 (1 and 2 of the VAT Law).

When talking about intra-community supplies of goods, refers to all those goods that are dispatched or transported from the territory of application of VAT to another Member State of the European Union. On the other hand, as for the intra-community acquisitions of goods, refers to all those acquisitions of tangible goods that are transported from one Member State to another with destination to the one who acquires it.

It is determined that when intra-community operations are carried out, and the purchaser of the products accredits its registration in the census of intra-community operations by presenting the intra-community NIF / VAT, then the company or professional that issues the invoice will apply the VAT exemption provided for cases of neutrality. However, it may also be the case that the issuer of the invoice presents the invoice with VAT, because the acquirer has not been credited with obtaining the NIF / VAT.

When these cases in which the issuer of the invoice issues it with VAT, and the recipient has the right to apply the exemption granted in Art. 25 and 26 of the LIVA, then the so-called mechanism of "VAT recovery", by means of which fiscal neutrality corresponding to cases of intra-community deliveries and acquisitions can be achieved.

In the case of Spain, there are two forms for these mentioned cases, which are; the Model 361 based on the "Request for refund of VAT paid by certain businessmen or professionals not established in the territory where the tax is applied, or in communities such as the Canary Islands, Ceuta or Melilla" and Model 360 is for businessmen and professionals who are established in the territory “Request the refund of the VAT paid in intra-community operations in the community”.

In what period must the AEAT Form 360 be submitted?

To file Form 360 and consequently Form 361, the request is made the following day when the calendar quarter ends or in such case in each calendar year and will end on September 30 following the calendar year in which the corresponding fees.

The minimum amount of the request is 400 euros if it is a period less than the calendar year and 50 euros if it is within the period of the calendar year.

How should Form 360 be filed?

The Model 360 corresponding to the request for refund of intra-community VAT Considered mandatory, it must be submitted electronically to the Tax Agency's website, this should not be a cumbersome procedure, since all businessmen and professionals are obliged to be in constant communication with this tax regulation body.

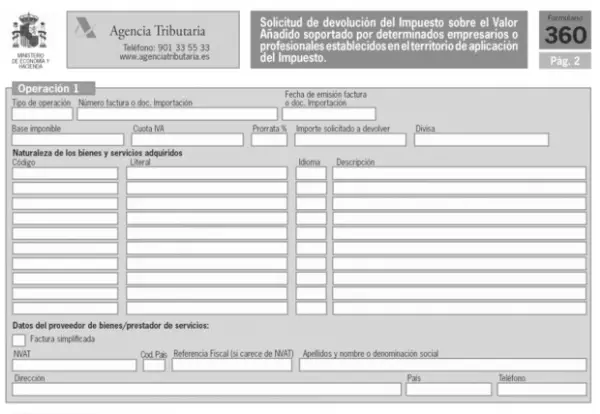

To present Form 360, it is necessary that the total refund amount which is requested for VAT quotas borne by the acquisitions or imports of goods and services that are carried out in other Member States other than Spanish territory. For this, the number of invoices that document the acquisitions of goods or services to which said request is referred reflected in the 360 form, or the number of DUAS that document the imports of goods or services to which it refers is required.

What are the expenses incurred outside of Spanish territory to present Form 360?

Next, the deductible expenses for VAT incurred abroad are:

- Shipping cost: Car rental, transport tickets such as airplanes, boats, trains, others are included. Also in the case of own vehicles, repairs and spent fuel can be deducted.

- Lodging: Leases in inns, hotels, others are included.

- Hiring professional services: specialists in legal procedures such as lawyers or notorious are included.

- Miscellaneous expenses: Expenses and consumptions that are related to the direct activity of the employer or professional are included, such as the purchase of work materials, telephone calls, others. It is important that they are duly justified. For this, the supplier's data and the respective invoice must be presented, being necessary the annex of the copy of the same.

What are the instructions for completing Form 360?

The steps to fill out Form 360 are:

- Access the Web of the State Tax Administration Agency (AEAT).

- Fill in the basic application data, including: the identification of the applicant, country and year of the exercise. You must describe the territory of establishment and the reason for its presentation, indicating the start and end date of the period. After completing this part, you will click "Send".

- In this step, the system will show the Form 360 online, with the data that was provided in the previous section. In the address you must indicate the data of the domicile of Spain with residence abroad or also place a mail box in Spain. If you have a legal representative, you have to fill in the data in the part that says "Representative".

- Fill in the requested return, in this step you must declare:

- The amount requested: Enter the total amount of VAT that is requested to be recovered, it must include supports of the acquisitions or imports of goods and services made in other countries. In this case, also those established in the Canary Islands, Ceuta or Melilla.

- The currencies: Enter the currencies used in the Member State of the refund.

- The number of invoices: Indicate the number of backup invoices that will be provided in the return request.

- The number of import documents: Enter the number of DUAS corresponding to imports of goods or services.

- The term: Indicate the start and end dates of the refund request.

- To conclude, click on the "Declaration" box.

Note: You can find at the top of the page a bar that will facilitate the tour of the Model 360, in this part you will have the option of being able to save the work, create a new presentation, examine the files already saved previously and send the completed form.