The Euribor has been negative for years and has broken the -0,5% barrier on several occasions. This is due to the fact that there were entities that had to 'pay' their clients for lending them money. However, this anomaly's days are numbered in the face of the upward evolution of the index to which 80% of mortgages in Spain are referenced.

The interest of the variable mortgage, in general, is calculated by adding a differential (which is fixed) and the Euribor. With the latter in negative and at historical lows, he became aware of the case that this sum turned out to be negative. In other words, the bank not only did not charge interest but actually had to pay it.

At the end of 2020 there was a great review in the financial sector that the entire authority positioned itself in favor of paying banks to have clients known for losses with negative interest. “I think the regulation should be applied in general. If there are no legal restrictions in any country or national authority, the contract will be performed as expected. If they go (the interest on mortgage loans) into negative territory, well, it is what the contract establishes and what must be respected”, said José Manuel Campa, president of the European Banking Authority (EBA, for its acronym in English). .

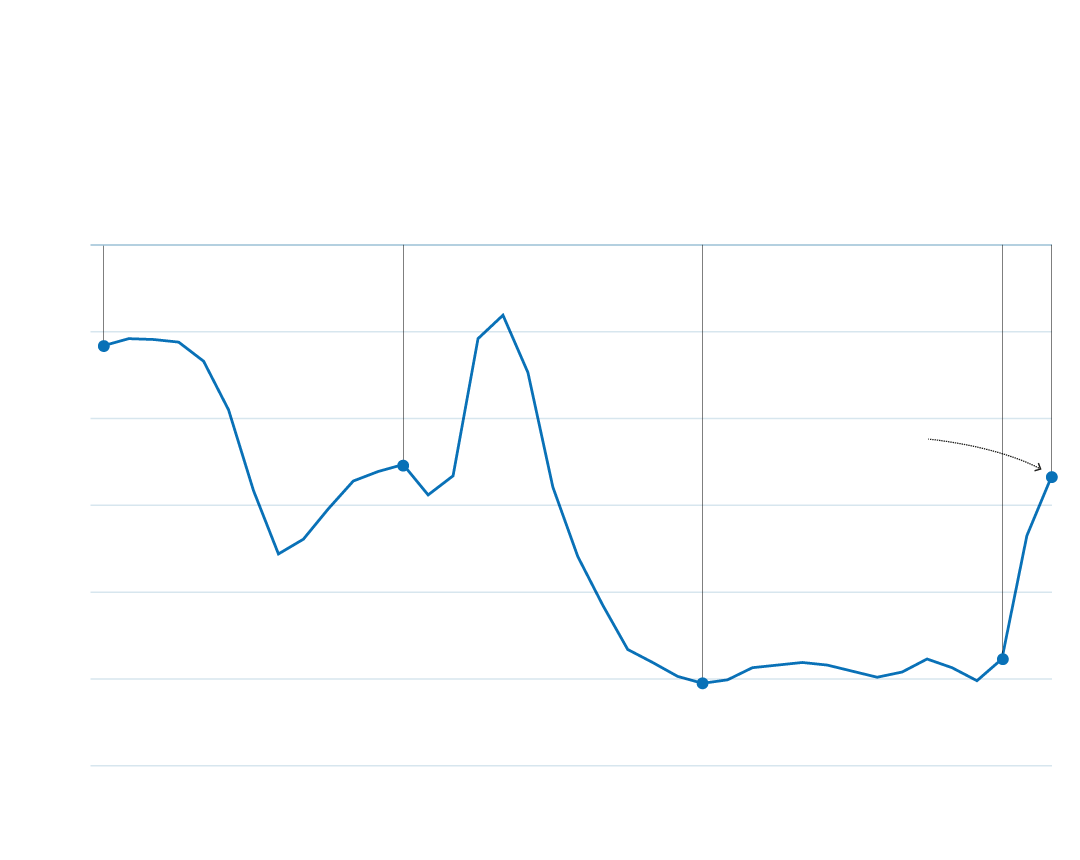

Evolution of the 12-month Euribor

In percentage (%)

Provisional average, until Friday

Winners will be announced in March

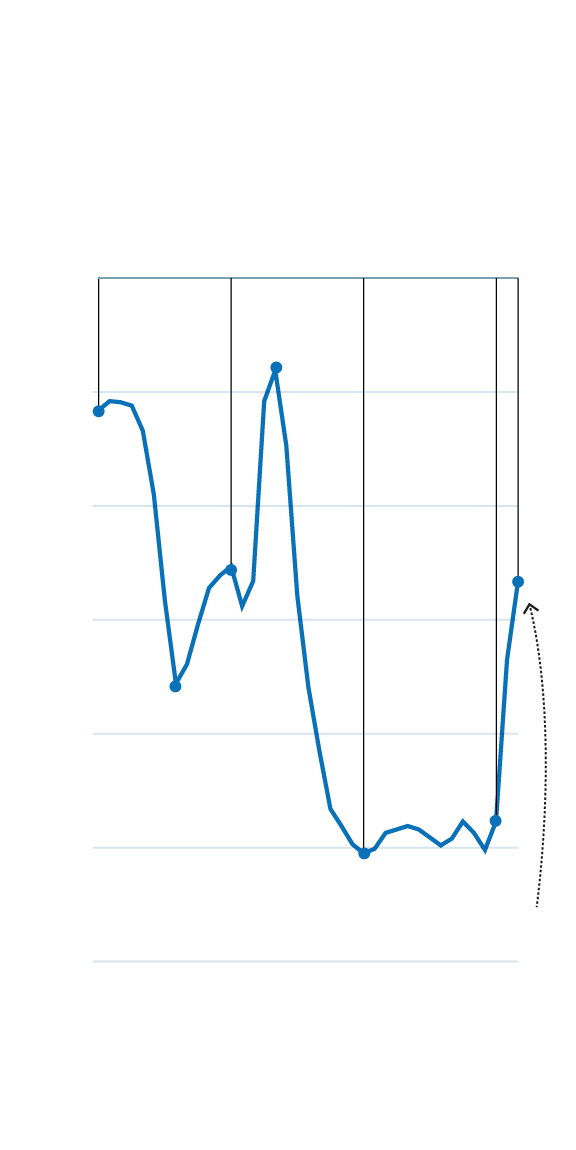

Evolution of the Euribor

at 12 months

In percentage (%)

interim media,

Until Friday 25 in March

The entities then defend themselves and refused to apply it in all cases since they consider that it goes against the nature of the loan contract itself. In addition, this legal debate could only be realized in the credits prior to the new mortgage law of 2019.

Thus, as ABC revealed, there were entities that were already complying with the plan of the president of the EBA. This is the case of Bankinter, where there were several cases in which the bank was 'paying' the customer for lending him money.

The assumptions detected were about variable-rate and so-called multi-currency mortgages, that is, they can be denominated in any of the divided rates agreed in the contract, a request from the mortgagee, and change the currency as they wish.

These mortgages for which the client is 'charging' will originally be denominated in foreign currencies, such as the pound, the yen, the dollar... and, with the ups and downs of the markets, the mortgaged opted to protect themselves in the euro. Once under the European currency, the differential applied was not enough to overcome the negative statistic of the Euribor.

There Bankinter -and also some other financial entity- began to pay negative interest to several of its mortgagees, after mutual negotiation. But that did not translate into the bank subscribing a diner to the customer's account in question. The chosen formula was to add it to the capital that was amortized each month of the loan. An example: if the user paid a monthly fee of 1.000 euros, Bankinter was amortizing 1.030 euros. The 30 euros difference between the two amounts is reflected in your receipts as interest with a negative sign.

This situation where it costs money for the bank to give credit is bound to end with the evolution of the Euribor. Compared to the -0.502% that was reached in the 12-month index this past December, now the average for the month of March is -0.266%… and foisendo. On Friday, March 25, it reached -0.142% and if this trend continues, it would already reach positive values in a few months.

At the time, when the index was at such negative values, it will be possible that the interest was negative on those mortgages with very low spreads, less than 0,5%.

However, in the scenario now of the aforementioned figures and even pointing to positive data, it will be inevitable that all clients end up with this anomaly of negative mortgage is that there is no difference so low as to be lower than the Euribor in the conditions in which it currently moves.

Strategies Change

Thus, the rise in the Euribor not only brings with it the end of negative mortgages, but also a change in the commercial strategy of the banks.

To date, fixed mortgages had been promoted as it was the only way to guarantee a minimum interest while the Euribor continued to fall. The prices of this type of product have even dropped below 1%.

Now that the index already points to enter the green, the bank has taken the opportunity to turn around its offer. They are already beginning to penalize the fixed rate -although it is still cheap compared to past times- and to promote the variable rate, hoping that it will give them greater economic returns. In this sense, Banco Santander, Bankinter, BBVA, Ibercaja... have already acted in response to the increase in the Euribor. They have made it fixed by increasing the cost of the loans, reducing that of the variables, or both at the same time depending on which cases.