![]() CONTINUE

CONTINUE

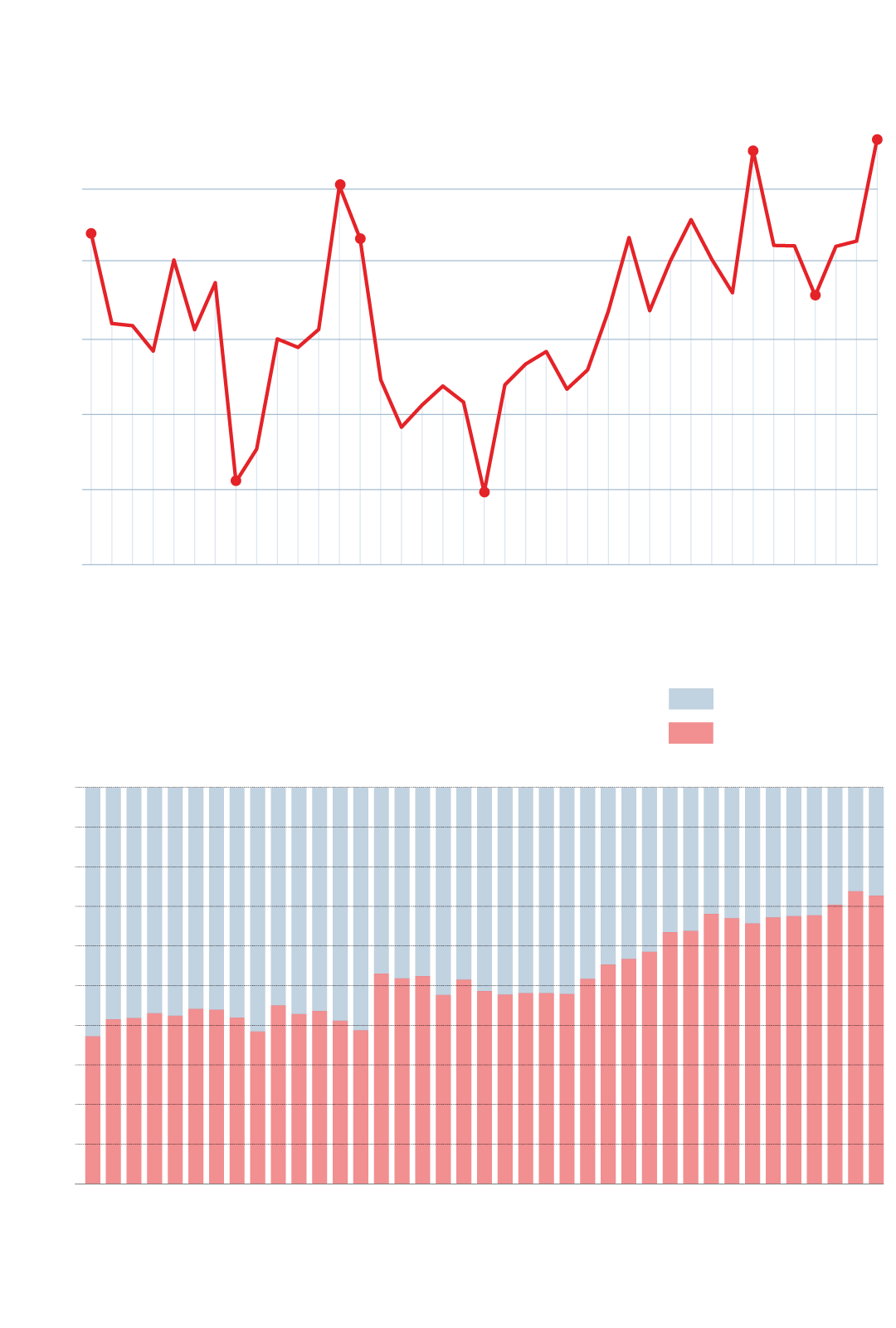

The Euribor curve is getting steeper and there is nothing to indicate that it will soften, but rather the opposite may be true. The index to which 80% of mortgages in Spain are referenced returned positive in April for the first time since 2016 and continued to climb in May. The concern among the mortgaged is increasing, and also among those who have to make the decision now.

Fixed-rate or variable-rate housing loan. Therein lies the dilemma among those who are currently launching to buy a house, because on the one hand the Euribor is still at abnormally low values; On the other hand, the forecast is that it will increase even more, but without knowing how much, and on the other, the financial entities are under pressure with their variable offers.

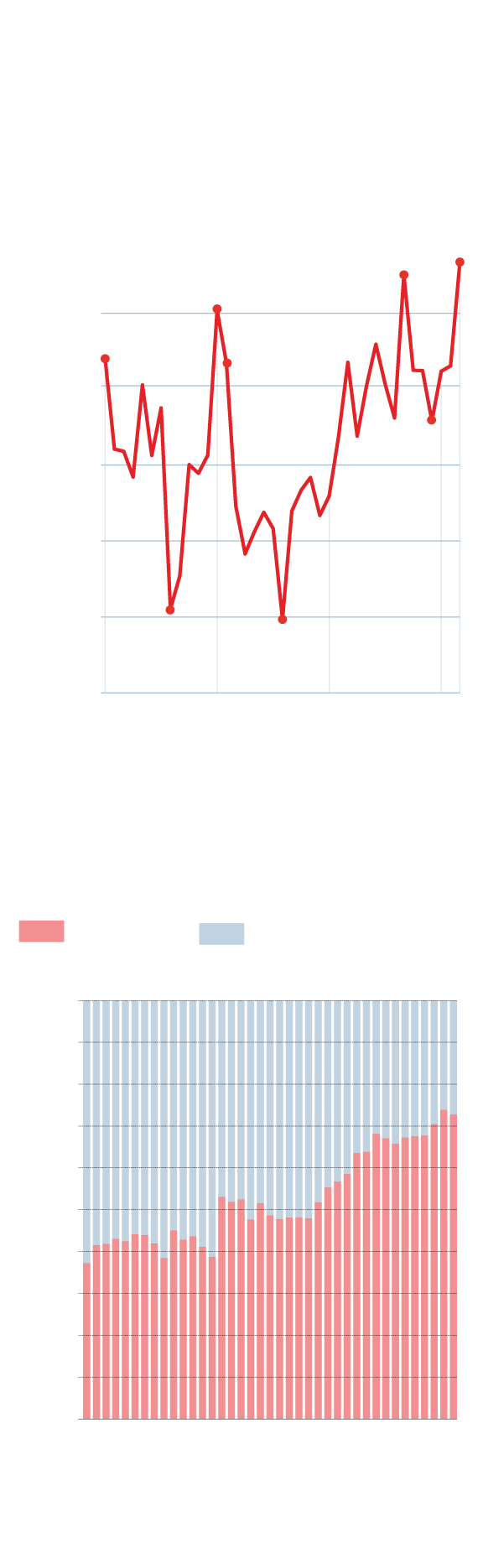

Evolution of mortgages

by number

Loans according to the interest rate

In porch on the total of each month

Evolution

of mortgages

by number

Second Loans

type of interest

In % of the total for each month

The data give a sample of how the demand behaves, but the uncertainty for the coming months is total. From the beginning of 2022, the Euribor began its climb and the reaction was immediate. It is true that in the last months of last year the number of mortgages that were signed at a fixed rate already exceeded 65%, but in January of this year the trend has sharpened to exceed 70%. The maximum peak was achieved at 73,8% of mortgages signed at a fixed rate in February, while in March these values continued to reach 73%. More than seven out of three sign up for this modality, when in 2015 it did not exceed 10%. Financial sources confirm that in the branches where the most is requested is the fixed rate and they still wait several more months under this scenario, waiting for greater economic clarity.

Consumers maintain their interest in fixed-rate mortgages due to the security it generates in the face of uncertainty, since they do not have shocks in the interest to be paid each month: the same is always paid, according to the mortgage advisor iAhorro. On the other hand, with the variable rate, you are at the expense of the fluctuations of the Euribor. However, from this same company it indicates that the trend will change and variable-rate loans will once again be the most common, as would happen historically in Spain not so many years ago.

Thus, the external factors that affect the Spanish economy, such as the war in Ukraine or the inflationary trend, make it difficult to prevent the evolution of the Euribor, which is sensitive to economic uncertainty and especially to the rise in interest rates of the Central Bank European (ECB). From iAhorro we expect the indicator to be around 1,35% at the end of the year and continue to rise until the economic situation normalizes –a higher forecast than the rest of the analysts, who speak more than 0,5%– . Currently, a close of May, it is located there at 0,287%, when in December it was negative at -0,501%.

Now users seem to continue to rely on the fixed rate because they can still find 2% for the life of the loan, which is still cheap compared to times past. The bank has been supporting home loans of this type since January and promoting the variable rate, with discounted interest offers during the first or first years of the loan. But this does not seem to convince mortgage holders, who prefer security over risk.

"With the real forecast of the Euribor, the profit margin for financial institutions increases in those of variable rate, which is reflected in the offers for this type of loan", they point out from iAhorro. The reality is that all banks are already betting on the variable rate, with the exception of Caixabank, which continues to trust in the possibilities of the fixed rate.