Maternity benefits provided by Social Security are exempt from paying Personal Income Tax (Irpf). This is not a topic known to most, but of utmost importance if you have already gone through this process and declared such tributes. As well as, for those who will start this path in the future.

In this case, if you have already gone through this process, you can request a refund of the amount.

This is great news for many parents, who can request a refund. First, it should be noted that fiscal years they are four years old to be able to exercise them. This means that those collected in 2015 or 2016 cannot be processed for exceeding this period of time. To avoid this, it is important not to waste time and that you inform yourself of all the necessary steps to carry out the procedure. Here we are going to explain every detail to you.

About maternity tax refund

In 2018 the Supreme Court ruled that all maternity benefits and paternity granted by Social Security on leave as parents they are exempt from paying the Irpf. This ruling was immediately executed with retroactive effects. This means that the refund of the amount withheld can be requested only in the years for which it can be requested.

As mentioned above, the fiscal years remain in force for four years, after exceeding this period, the refund cannot be requested. That means that, today in 2020, only those who were in this facet in the previous four years. This news brings as a consequence the benefit of millions of parents throughout Spain.

As this measure was ruled in 2018, those who declared at that time did not have to do any paperwork because their presentation in 2019 was already exempt from the amount. However, those who were in these circumstances years ago, must carry out a specific procedure to request a refund. If you are part of this group, here we are going to show you how to request a refund.

Step by step to request maternity withholding

La Maternity benefit is a right granted by Social Security working mothers -and fathers- for the birth and care of their child. In addition to a momentary absence from work, financial support is also provided to assume this period. Later, when making the Income Declaration, a percentage of this total was withheld. Here I explain the steps to request a refund.

First, it is necessary to know that there are two ways to carry out the procedure:

Through Internet

From the Electronic Headquarters of the Tax Agency it is possible to carry out the procedure online. For claim the amount, you just have to go directly to this link. Once inside you will follow these steps:

- Go to the "All procedures" box and click on "Appeals, claims, other review procedures and suspensions".

- Next, click on "Rectification of Tax Management declarations".

- Mark on «Presentation of appeal or request».

Next, the platform requests an identity document or access directly with Electronic certificate or DNI. After accessing, a very simple online form must be completed where the applicant's data is recorded. As well as the period of time that the benefit was collected and the year. At this point, a bank account where the percentage withheld will be refunded. It is important that, before sending, you check that all the requested information is correct to avoid future inconveniences.

Via in person

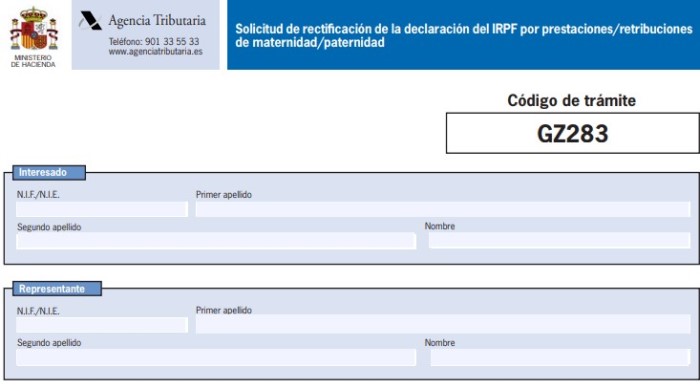

In case of trying the face-to-face option, the procedure is different. To do this, you must make an appointment at the headquarters of the Tax Agency closest to you. After that, go and ask for the form to fill out physically and complete the process. It is very easy and will only take a few minutes. It is also possible Download the form from the Tax Agency website, fill it out online and take it to your face-to-face appointment. If you want this modality, you can acquire the document here.

Filling out this form is easy. It contains the same information as the web form and the physical one. It is important to verify the information and sign the document before delivering. It is not necessary to attach identification documents or any other, since the Treasury has all your data and will be in charge of calculating the percentage to return.

How much money is charged for the return of the Irpf?

The amount to be received is not the same for everyone. This will depend on characteristics of the service and the percentage that was discounted at the time. For these issues, the administration has different tranches in which, the more the person who charges the most is retained. So, they are the ones who will have a greater amount to receive. Another variable is that the time in which it was in this condition is also taken into account.

For example, mothers will have a higher percentage to receive because they receive a greater amount in maternity benefits than maternity benefits, in addition, mothers have a longer time on sick leave than fathers. The average amount received by mothers is 1.600 euros, while that of fathers is 383 euros. These amounts are part of the average and the estimate. As we already indicated, the amount to be received will depend on different variables.

Now that you know how simple the procedure is and you have the information in your hands, it is time to start. Do not wait for your term to expire and make use of your rights.