![]() LANDELA

LANDELA

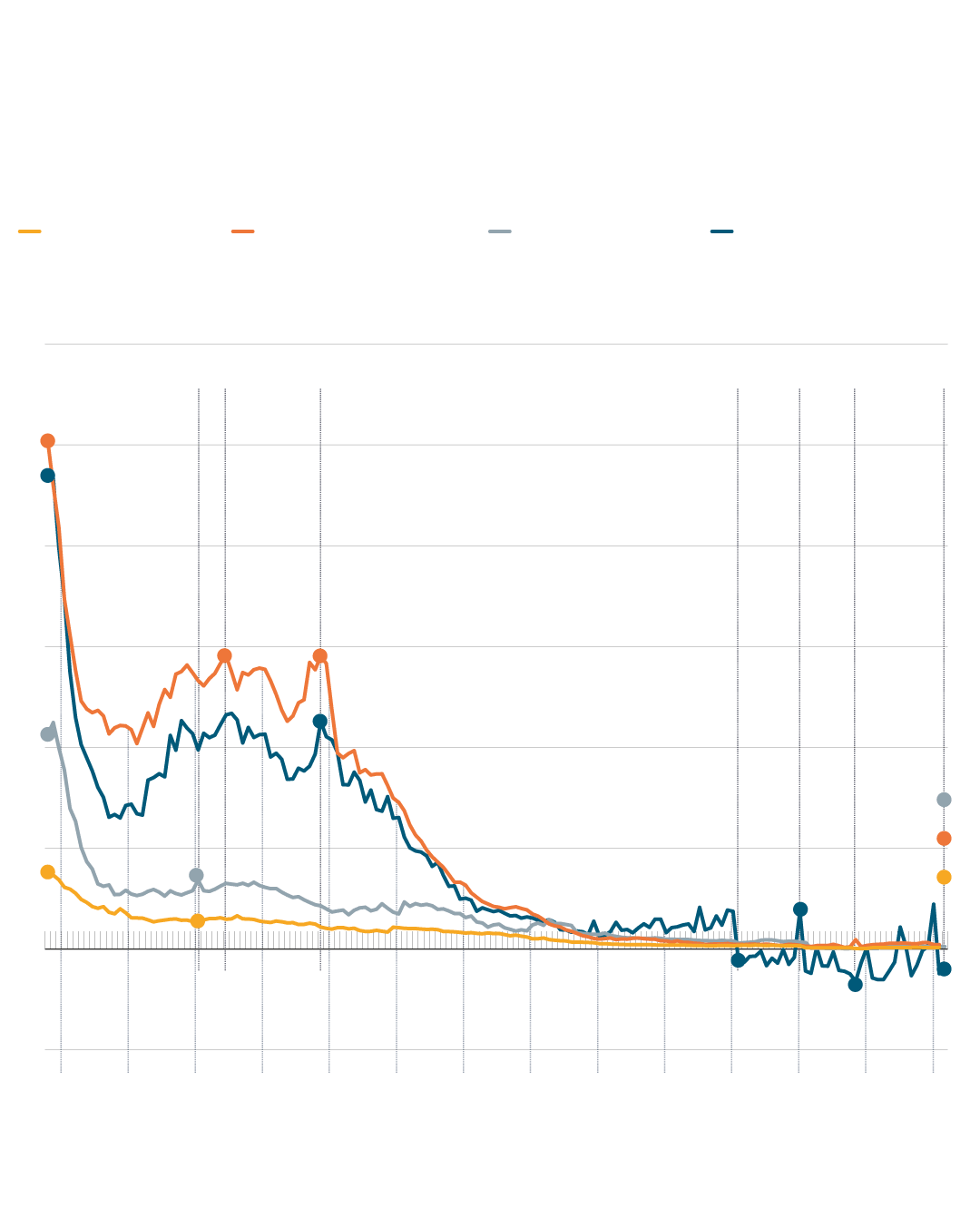

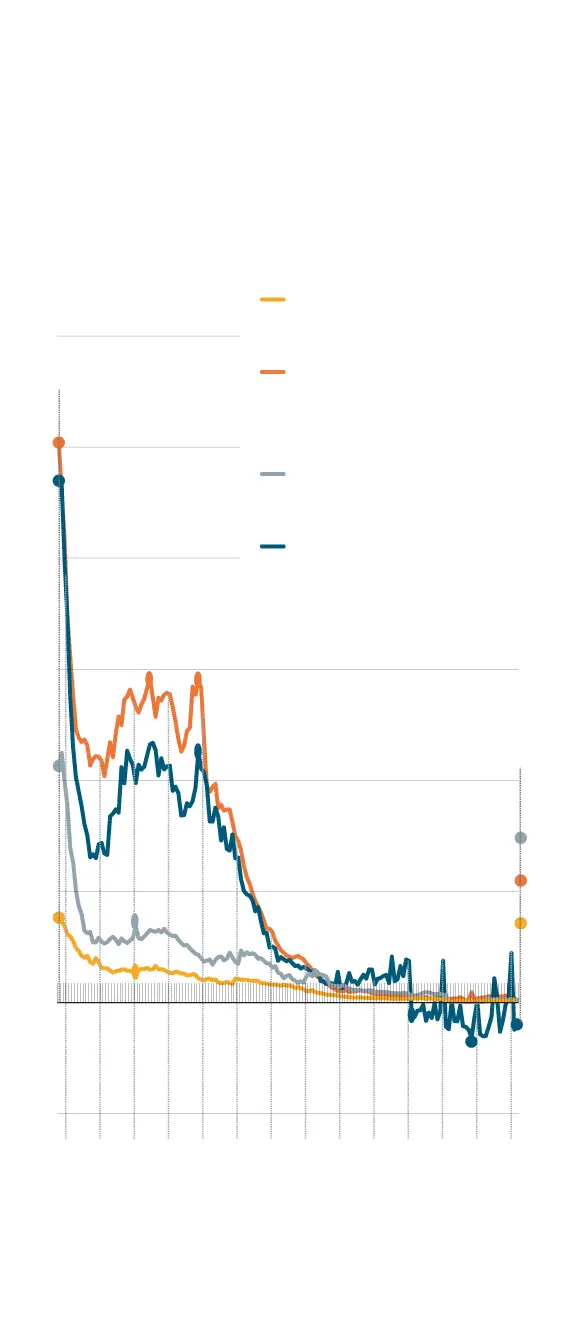

ISpain ibisoloko iphathisa ukonga kwayo kwiidiphozithi; mhlawumbi ngokubona (iiakhawunti zangoku) okanye ixesha. Iimveliso ezinobuncwane obukhulu, zikhuselekile kakhulu kwaye, ngelo xesha, zinengeniso. Ngoku imbuyekezo ebonelelwa ngamabhanki i-zero kwaye imbi kwiimeko ezithile ... kodwa oko kuza kutshintsha kwixesha elifutshane eliphakathi. Ibhanki iya kuhlawula kwakhona olu londolozo.

Ekupheleni kukaFebruwari 2022, ngokutsho Bank of Spain, amakhaya ngaphezu 960.000 million euro kwiidiphozithi, uninzi lwazo akhawunti zangoku. Iinkampani, ezinye izigidi ezingama-305.411, nazo ikakhulu zibonwa. Ngalo lonke ixesha amanani aphezulu, kodwa uqwalaselo lwayo lwahlukile xa kuthelekiswa neminyaka edlulileyo, ekubeni kwintlekele yangaphambili eyona nto yaphuka kakhulu, ngamanye amaxesha, ibiziidiphozithi zexesha hayi iidiphozithi zamehlo, kwaye ngoku kuchasene.

Kutheni iidiphozithi zexesha zazinomdla kakhulu kwiminyaka elishumi yokuqala yee-2000s? Ngesibambiso abanikela ngaso kunye nomvuzo abawunikelayo. Ezi mveliso zekota ziye zanika ingxelo engaphezulu kwe-5% yembuyekezo kumakhaya (idatha ukususela ngo-Oktobha ka-2008) kunye ne-4.7% kwiinkampani. Emva koko, ingxaki yezitena kunye nokuphazamiseka kwezemali kuphelisa konke oko.

Ukuzivelela kwabachaphazelekayo

yeedipozithi

amakhaya

Gcina amehlo akho

amakhaya

Iidipozithi zexesha

ireyithi ephakathi

Iinkampani

Idiphozithi ngokubona

Iinkampani

Iidipozithi zexesha

ireyithi ephakathi

Umthombo: IBhanki yaseSpain / ABC

Ukuzivelela kwabachaphazelekayo

yeedipozithi

amakhaya

Gcina amehlo akho

amakhaya

Iidipozithi zexesha

ireyithi ephakathi

Iinkampani

Idiphozithi ngokubona

Iinkampani

Iidipozithi zexesha

ireyithi ephakathi

Umthombo: IBhanki yaseSpain / ABC

I-European Central Bank (ECB) yagqiba ekubeni ithathe amanyathelo ngokukhukulisa iimarike ngemali yokuhlawula amatyala, unyaka nonyaka. Ireferensi yenzala yaya kutsho kwi-0%, apho ikhoyo nangoku, neyaziwa ngokubanzi njengexabiso lemali njengoko kubiza iibhanki ukuyiboleka kumphathi; uhlobo lwefasilithi yediphozithi -into i-ECB ibiza iibhanki ngokufaka umbane ogqithisileyo kwi-akhawunti yayo- uyibeke kwi-negative kwi -0,5%. Loo mali yaba lilize.

Kule meko, eqhubekayo, iibhanki azikwazanga ukuhlawula oko zihlawule kwiidiphozithi kwaye kwiminyaka edluleyo ziye zatshonisa inzuzo yazo. Kwidiphozithi ngoku amakhaya ahlawulwe, ukubona kunye nexesha, phakathi kwe-0.01% kunye ne-0.04%. Ngeenkampani, umfanekiso ubi nakakhulu: ii-akhawunti zangoku zinesivuno se-0,02%, kwaye iimveliso zekota zi-0,19%. Oko kukuthi, iinkampani kunye nabathengi bamaziko bade bahlawuliswe ngokwamkela iidiphozithi zabo.

Iibhanki azikaze zihlawulise amakhaya ngokugcina imali yawo, kodwa yimeko etyalwe kweli candelo izihlandlo ezininzi. Okokugqibela, iibhanki azizange zenze njalo ngenxa yeendleko zesidima kunye nokulahleka kwabathengi okunokubandakanya.

Inyaniso kukuba iibhanki zikhalaza iminyaka malunga nokwandiswa komgaqo-nkqubo we-ECB wendawo. Eli candelo liva ukuba kwingxaki yangaphambili uMario Draghi, njengomongameli we-supervisor, kwafuneka enze izigqibo ezingaqhelekanga, kodwa ikwakhuthaza ukuba imeko iqheleke ngokukhawuleza. Elona nani liphezulu lokunyuka kwamaxabiso kumashumi eminyaka kuye kwafuneka lifike ukuze oku kwenzeke. I-ECB kaChristine Lagarde ngoku ekugqibeleni icinga ukunyusa amaxabiso enzala, xa sele igqibile iinkqubo zokuthenga amatyala, ukuqulatha ukunyuka kwamaxabiso. Kuya kwenzeka ukusuka ngoJulayi, ngokujonga izibhengezo zamalungu eBhunga eliLawulayo, nangona ukwanda kokuqala kunokulibaziseka kude kube sekupheleni konyaka. Kwaye ukunyuka kwamaxabiso kuthanda ishishini lebhanki, kuba imali inexabiso kwakhona, kodwa kunye nabalondolozi, ngokwemithombo yezemali, ekubeni ukugcinwa kuhlawuliswe iminyaka. Akunjalo kakhulu malunga nokukhangela ukuncipha kwemali, kodwa malunga nokuyeka ukwanda kweminyaka yakutshanje kunye nokulungelelanisa imeko, njengoko kubonisiwe kwimanyano yebhanki.

I-ECB ikhuthaza imarike

Ngaloo ndlela, imarike sele isaphulelo ukuba kuya kubakho ukunyuka kwezinga le-ECB kwiinyanga ezizayo - ngokubonakalayo, umzekelo, amaxabiso ebhanki, i-Euribor ebuyele kwizinto ezintle ... -, kwaye oku kubangela ukuba amaqumrhu alungiselele. ibhalansi yabo yento ezayo. Oko kukuthi, ukunyuka komvuzo onikezelwa kubathengi bayo kwiidiphozithi, kodwa kunye nokunyuka kweendleko zekhredithi, okuya kuthetha ukuqiniswa okuthile kokufikelela kwiinkampani kunye neentsapho.

Imithombo yezemali iqinisekisa ukuba iibhanki ziya kuphinda zihlawule iidipozithi, kwaye ziyakunyusa iindleko zeemali-mboleko. Siyazi ukuba kukho ukungahambi kakuhle kwaye sele kusemva kwexesha kakhulu ukuba sichithe uloyiko lwabantu kunye neenkampani. Nangona kunjalo, oku akuthethi ukuba izinga lenzala le-5% lenzeke ngo-2008 liya kufikelelwa ngoko nangoko.Unyuso luya kuhamba ngokuthe ngcembe ngokuhambelana nezigqibo ze-ECB, kwaye kuthathelwa ingqalelo umda elinawo iqumrhu ngalinye.

Kule meko, imithombo edityaniswe nayo ibonisa ukuba imfazwe esele ibanjwe i-mortgages inokuphinda idluliselwe ekubambeni iidiphozithi zexesha eliphakathi, nangona i-melon engekavulwa.