Among the models presented by the Tax agency find the Model 002. In order to effectively enforce tax obligations, the State Tax Administration Agency has generated forms known as Models to guide the citizens.

In this case, the form 002 will serve us to comply with the payment of the self-assessments of our tax debts in installments or in installments. It will even serve us in the case of being a self-assessment in a voluntary or executive period. In case of societies or not Residents en Spain, you can fill in the Model 202 for the fractionation of payment of the rent.

In this other article you can know what the Certificate of withholding in income from irpf.

Periods to pay

Voluntary

To pay the self-liquidation of tax debts we can always do it in the period determined for it by the Tax Agency. This is called voluntary period, because the taxpayer takes the initiative to make the payment within the established period.

Executive

On the other hand, is the executive or out of deadline set by the Agency, in which they are imposed on us surcharges by time delay of payment.

Fill in Form 002

Header:

First, you must enter your identification data on the first page:

- Name and surname or company name, DNI or NIF.

- Home address

- Phone

Tax debt

It identifies <strong>financial incentives</strong>, grants and loans from local, regional and European institutions. what is the debt that you must pay and mark it in the form. To do this, you must place what self-assessment number corresponds and how much is the amount.

- Self-assessment number Specific debt.

- Exact amount.

Postponement and fractionation

If you do not have the amounts, you can choose other options that facilitate payment, be it a postponement o division thereof.

If you decide to split it, you just have to check the option and point in many fractionations you will make the payment.

With the posterior Decision you will know if they have indeed acknowledged o denied the options you have chosen.

Warranty

There is the option of offering a guarantee that supports the moment of paying the debt.

You can submit any of these:

- Surety certificate

- Personal or solidarity bond

- Mortgage

- Garment

- Bank guarantee

No warranty

If you do not have assets or titles to guarantee payment, it will be considered in a situation of dispensation.

Direct debit account information

Finally, we are required to provide the information regarding the domiciliation of payments.

Make the payment

We recommend that you previously deactivate any of your browser's programs.Before accessing the payment form, it is advisable to deactivate the pop-up blocker, as this may prevent you from correctly obtaining the proof of payment (remember to re-mark it when you have finished the process ).

- To do this you must enter the Electronic Office (via telematics). Login here. Click.

- Then, select "Tax Payment" to open the "settlements / debts" option.

You will need a Electronic DNI to access and then make the payment with a bank card or make charges to your account.

I do not have an electronic ID

If this is your case, you can enter with the Cl @ ve PIN, system now available from 2015. In this case, you could not pay with a bank card, but only for charges to your account.

In any case, if you have not yet registered your Cl @ ve PIN you can do it here. click

- You choose the payment type that you will do either by account charge or card payment.

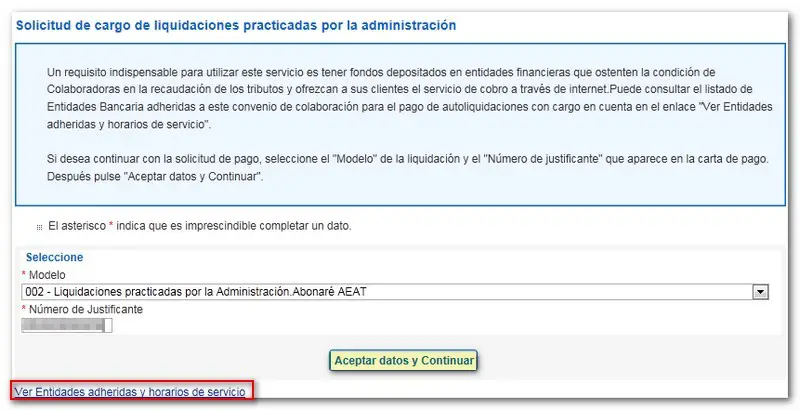

- Verify that the bank is collaborating with the Tax Agency. In the lower part you will see what are the member entities, as well as information about your hours of operation.

- Having accessed, select the concept of model 002 that will be filled with information as directed.

- Enter the receipt number in the payment letter that the bank of preference should have issued. Press "Accept data and continue"

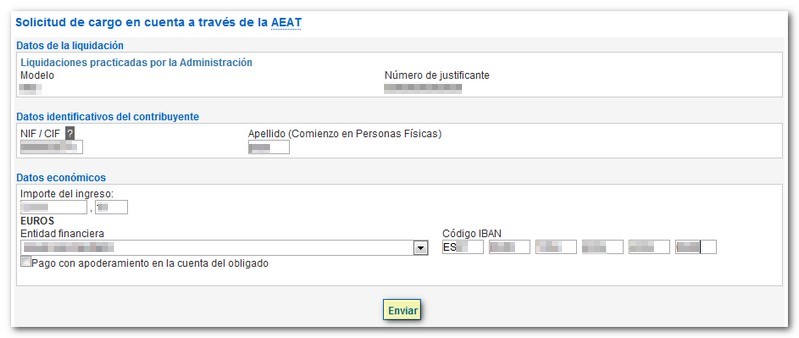

- You will be presented with the form of the model 002 that you will have to fill in. Do it and then click submit.

- You will be able to see this window of data that you have already filled out, check that they are correct and mark "Agree" to send and finally confirm your payment.

- The number will be automatically generated NRC (Full Reference Number) that you should keep, as it serves as proof of payment online. It is recommended to print the screen to have the receipt of the operation, which also leaves you a summary of the data entered.

Addition NRC You will no longer have to carry another document.

Failures

If there are circumstances of failure in communication (connection) you can review and even recover the information of your NRC. Among the options offered by the settlements / debts page, there is the one of "consultation of previous payments". In the case of having made the payment.

Enter the same information that you previously sent to make the payment. You should see the NRC .

Alternatives

You may not have the necessary identification system to access. Please note that you can get the NRC in person or through the electronic banking service. (if the bank offers the service)

In the first case, you just have to go to the bank's office and present the data of the respective settlement. You must not wear a physical model. Just have the information they ask for to make the payment on the Agency page:

- Número de modelo

- Last Name

- Declarant NIF

- Exercise

- Period

- Exact income amount